Globe’s1 consolidated gross service revenues grew by 3% to P41.1 billion in the first three months of 2024, despite the decline in home broadband and non-telco services. This strong performance was fueled by the robust growth of its mobile and corporate data businesses, which accounted for 83% of the topline. Mobile revenues grew 8%, and corporate data revenues climbed 10%. Globe’s data revenues in the first quarter of 2024 saw a notable increase, reaching 85% of total consolidated gross service revenues, up from 82% the previous year. On a comparable basis, where the prior period is adjusted to assume the

deconsolidation of ECPay from Globe’s books in Q1 2023 (with the sale of its 77% stake in ECPay2 to Mynt), Globe’s total consolidated gross service revenues would have grown higher by 5%.

Amidst the challenging economic conditions impacting consumer spending, Globe’s mobile business exhibited unwavering growth, recording P29.1 billion in revenues as of end-March 2024, or up 8% from last year’s P27.1 billion. The driving force behind this success is Globe’s effective market repair efforts, as customers continue to choose Globe for its differentiated network quality and service. Total mobile revenues now account for 71% of the total consolidated gross service revenues, up from 68% a year ago. This is a testament to the Company’s robust business model and strong customer base, which reached

58.8 million mobile customers for the first three months of the year.

From a product perspective, mobile data revenues grew by 10% to P23.8 billion for the three-month period this year, from P21.7 billion a year ago. This was mainly fueled by the Filipinos’ increasing reliance on mobile devices for various activities such as online shopping, streaming media, and engaging in social media. The widespread use of smartphones and the growing popularity of data-intensive applications have further contributed to this revenue growth. In the same period, mobile data traffic soared to 1,610 petabytes, up from 1,352 petabytes reported in the same period of 2023. Mobile data now accounts for 82% of mobile revenues from 80% last year. Conversely, traditional mobile voice and SMS revenues ended at P3.4 billion and P1.9 billion, lower year-on-year by 2% and 3%, respectively.

During the first quarter of 2024, the corporate data business experienced continued growth, driven by the company’s dedication to delivering innovative solutions that assist in digital transformation and cater to the needs of its enterprise clients. The corporate data revenues increased by 10% year-on-year to approximately P5.0 billion, primarily driven by the growth of core data services by 12% and information and communication technology (ICT) services by 7%.

Home Broadband’s revenues, on the other hand, declined by 6% to P6.1 billion in the first quarter from P6.5 billion a year ago, due to the drop in fixed wireless but was partly cushioned by the positive growth of postpaid fiber. The postpaid fiber segment, accounting for 84% of Home Broadband, exhibited positive growth, with a 3% increase in subscribers and revenues year-on-year. However, home broadband revenues were flat compared to the fourth quarter.

The decline in Globe’s fixed wireless revenues is decelerating, consistent with the company’s guidance. The initial surge in demand for reliable data connectivity during the COVID-19 pandemic led to a significant increase in sales for the company’s Home Prepaid WiFi product. However, as market preferences shifted towards more stable wired connectivity post-pandemic, fixed wireless metrics began to normalize and declined gradually, aligning with earlier expectations. Globe anticipates that this positive trend, combined with the new GFiber Prepaid, will enable positive growth in total broadband revenues during the second half of this year.

Additionally, customers have been highly receptive to GFiber Prepaid since its launch in the latter half of 2023. The positive feedback highlights the service’s strengths, including its fully digital experience, affordability, reliable network connectivity, and convenient loading via GCash. This demonstrates Globe’s understanding of the prepaid consumer market’s needs and has resulted in a 53% growth in acquisitions in the first quarter. Notably, April witnessed a threefold increase in GFiber Prepaid acquisitions, indicating the service’s promising growth trajectory, which is anticipated to continue during the latter half of the year.

The total subscriber base of Home Broadband dipped by 26% to 1.7 million from 2.3 million in the year earlier, mainly due to the normalization of the fixed wireless broadband as the market transitions towards more reliable wired connectivity. Likewise, HPW data traffic declined from 86 petabytes in the previous year to only 54 petabytes in the current reporting period.

The Company’s non-telco revenues declined by 60% year-on-year compared to the P1.4 billion reported at the end of March the previous year. This sharp drop resulted from the deconsolidation of ECPay from Globe’s books, following the sale of its 77% stake in ECPay to Mynt in September 2023. However, if ECPay’s deconsolidation had been reflected in Globe’s books during the first quarter of 2023, total non-telco revenues would have been lower by only 31%.

Meanwhile, Globe’s total operating expenses including subsidy jumped to P19.8 billion in the three-months period of 2024 from P19.5 billion a year earlier. The Company’s cost-saving efforts, which included lower marketing & subsidy as well as provisions, were offset by increases from leases, repairs and maintenance, staff costs and administrative expenses.

For the first three months this year, Globe’s consolidated EBITDA reached P21.4 billion, or up a solid 4% from a year ago. This was primarily driven by a 3% increase in the topline, partly offset by a 2% surge in operating expenses (including subsidy). Likewise, the Company’s EBITDA margin has increased year-on-year, rising from 51% to 52%, outperforming the full-year guidance of 50%. This expansion is a testament to the company’s dedication to maximizing operational efficiency and ensuring continuous development.

Mynt, Globe’s fintech arm, maintained its upward momentum, further solidifying its position as the largest cashless ecosystem in the Philippines. GCash remains the preferred choice, empowering an increasing number of Filipinos with a diverse range of digital financial tools and services, resulting in significant growth in both user base and profitability. Globe’s share in Mynt’s equity earnings for the first quarter of the year amounted to P962 million, which now accounts for 11% of this period’s net income before tax versus 4% from the year earlier. Compared to the same period last year, Mynt’s equity earnings grew by 138%.

Net income declined by 7% to P6.8 billion compared to the P7.3 billion reported in the previous year. This was mainly attributed to higher depreciation expenses and non-operating charges, as opposed to non-operating income in the same period last year. Excluding the one-time gain from the tower sale, normalized net income would have been at P5.8 billion, reflecting a 13% increase compared to the previous year.

Accordingly, excluding the effects of non-recurring charges, foreign exchange, and mark-to-market charges, Globe’s core net income soared to P5.8 billion this period, a significant 13% uptick compared to the same period last year.

Globe’s balance sheet remained healthy with gearing comfortably meeting bank covenants with total debt improving from P250.0 billion as of end-December 2023 to P246.7 billion this period, Globe’s gross debt to EBITDA is at 2.70x while net debt to EBITDA is 2.52x; and debt service coverage ratio is at 1.89x.

“Our financial performance for the first quarter exceeded expectations, with an impressive 52% EBITDA margin, indicating a positive start of the year and building momentum going into the coming quarters.” said Ernest L. Cu, President and CEO of Globe Telecom Inc.

“We are also pleased with the progress of our landmark tower deal with the successful transfer of a significant portion of the towers, reaching nearly 70%. We have put in place plans to ensure that the majority of the proceeds will come in by the first half of the year. This move puts us in a solid position to meet the dynamic connectivity demands of our customers and stay at the forefront of the industry.”

“Guided by a clear strategic focus on innovation and customer-centricity, we are confident in our ability to overcome challenges and seize the opportunities to create a brighter and more connected future for the Philippines.” Mr. Cu added.

Key Business Highlights: 22% Yearly Decline in Capex at P13.7 Billion

As of the first three months of the year, Globe invested P13.7 billion in capital expenditure (capex), lower by 22% than the similar period of 2023. This effort to reduce its capex spending is in line with the Company’s continued focus on optimizing capital deployment and bringing free cash flows into positive territory by 2025. Around 91% of this period’s capex was allocated for the data requirements to ensure that customers will be able to access essential digital services as well as entertainment options anytime and anywhere.

In 2023, Globe shifted its focus from opportunistic capacity expansion to optimizing network investments. This strategic change led to positive results, enabling a return to sustainable capital expenditure (CAPEX) levels without compromising network quality or capacity. As a result, there was a significant decline in purchase orders (POs) issued last year, which continued into the first quarter of 2024. During this three-month period, POs totaled only US$ 131 million, representing just 53% of actual CAPEX. These streamlined PO issuances align with the Company’s plan to achieve positive free cash flow.

Moreover, with Globe’s firm dedication to deliver dependable and high-speed internet connectivity nationwide, Globe built 116 new cell sites, and upgraded 812 mobile sites to LTE as of end March 2024. The company also deployed 19,544 fiber-to-the-home (FTTH) lines, notably lower than last year’s rollout to maximize the utilization of its existing fiber inventory and this year’s reduction in capex.

The Company likewise deployed 27 new 5G sites across the Philippines, increasing its 5G outdoor coverage to 98.35% of the National Capital Region and 92.86% of key cities in Visayas and Mindanao for the first three months of the year. Globe also logged over 6 million devices in its 5G network in March 2024. In addition, Globe expanded its 5G partnerships with 167 global partners in 87 destinations.

Globe’s ongoing efforts to expand and enhance its network is aligned with its dedication to the United Nations Sustainable Development Goals, specifically SDG No. 9, which emphasizes innovation and infrastructure as crucial catalysts for economic advancement.

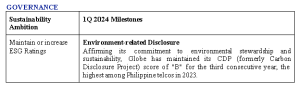

Lastly, Globe has taken the top spot as the Philippines’ most valuable telecom brand and seventh place in the ASEAN region, beating its main local competitor, based on the Brand Finance3 Telecoms 150 2024 report. This notable ranking is accompanied by an impressive AAA brand strength rating, demonstrating Globe’s commitment to excellence and its ability to consistently meet customer expectations through innovative services and solutions.

Recent Development:

Tower Sale and Leaseback Deal:

- On March 14, 2024, Globe successfully transferred additional 154 towers to MIDC for ~P1.85

- On March 25, 2024, Globe turned over another 91 towers to Frontier Towers for approximately

~P1.16 billion and 33 towers to Unity for a cash consideration of P396 million.

- On April 16, 2024, Globe closed 90 towers transferred to PhilTower for approximately 3 billion.

- On April 26, 2024, Globe turned over additional 181 towers to MIDC for ~P2.17

- On May 10, 2024, Globe closed 100 towers transferred to PhilTower for roughly 5 billion

Overall, Globe has secured proceeds of approximately ~P67.3 billion, representing around 69.5% of the tower deal, through the official transfer of ownership of 5,216 out of 7,506 towers sold.

Data Center Update:

- STT Fairview is progressing according to schedule, with operations expected to start in early Structural work is underway in preparation for the installation of second-level equipment, which is scheduled for June 2024.

- STT Cavite 2 has wrapped up its design phase and secured all necessary pre-construction permits, targeting operational readiness by mid-2025.

Network Related Update:

- Globe has activated a segment of the Philippine Domestic Submarine Cable Network (PDSCN) from Luzon to Mindanao, signaling the start of on-ground connections to serve more Globe’s segment in the PDSCN Express Route was lit up on February 5, covering the following points: Lucena City, Quezon; Boac, Marinduque; Calatrava, Tablas Island, Romblon; Roxas City, Capiz; Placer, Masbate; Palompon, Leyte; Mactan, Cebu; Talisay City, Cebu; Tagbilaran City, Bohol; Cagayan de Oro City, Misamis Oriental.

https://www.globe.com.ph/about-us/newsroom/corporate/new-submarine-cable-segment-luzon-to-mi ndanao

- Through a partnership sealed in February 2022, Globe and Converge embarked on its first joint project in 2022: a co-build spanning 137 kilometers from Pili, Camarines Sur, to Legazpi City, Albay. Utilizing cutting-edge technology, this venture includes the deployment of state-of-the-art microduct solution underground facilities. This project wrapped up in Q3 of 2022. Following the success of the initial undertaking, a second co-build project in Leyte Province began in the third quarter of 2023. Spanning 209 kilometers to connect Tacloban and Maasin via Baybay, it is currently 80% complete and is expected to conclude by the third quarter of 2024. https://globe.com.ph/about-us/newsroom/corporate/globe-converge-co-build-projects-bicol-ley te

Key Portfolio Company Highlights: Non-Telco Revenues dropped 60% YoY but Share in Equity Earnings from Affiliates grew by 230% YoY

Globe has evolved beyond the core telco business into a strengthened digital ecosystem of products and services that target the needful sectors in financial inclusion, healthcare, education, environment, business enablement, and more. From its core telco business, Globe has grown its portfolio with ventures in financial technology, healthcare, edutech, climatech, entertainment, adtech, e-commerce, manpower, information technology services and investments.

GCash remains the leading cashless ecosystem in the country, bannered by ubiquity across its active user base, which is 5x larger than the next e-wallet, based on statistics from reputable third-party provider data.ai. To complement its ubiquity across its consumers, GCash has also built the largest network of online and offline merchants and social sellers (over 6 million partners) and hosts over 1,000 merchant partners in its app, via GLife. Built on trust and the security of its brand and platform, GCash was recently recognized by the Asia-Pacific Stevie Awards for the Innovative Use of Technology in Customer Service and for Innovation in Digital Transformation. Alongside this, GCash was recognized by Pan Finance as the best mobile wallet in the Philippines in 2024, and was also given the Company of the Year Award for the Philippines’ Financial Technology Industry from leading global analysis and growth strategy consulting firm Frost & Sullivan. These awards recognize GCash’s pioneering use of digital solutions and innovative financial services and its strong overall achievements in the financial technology space.

GCash boasts of the most comprehensive suite of digital financial services, covering savings (via GSave), investments (via GFunds and the recently launched GStocks PH and GCrypto), and insurance products (via GInsure). On credit, backed by its proprietary trust platform and credit scoring via GScore, GCash has provided access to credit to over 4.5 million borrowers, of which the majority are from lower socio-economic classes and ½ are women. These milestones were achieved through game-changing lending products covering credit lines (GCredit), cash loans (GLoan), buy-now-pay-later (BNPL, via GGives), and the newly-launched micro-credit starter loans (Sakto Loan and Borrow Load), providing loans to more Filipinos who need it the most, continuously paving the way to its vision of Finance for All.

In line with its financial inclusion mandate, GCash has gone beyond the nation’s borders and now offers payments in 47 countries through GCash Global Pay. In partnership with Alipay+, this feature offers a hassle-free travel experience abroad through a seamless and secure payment experience across various merchants through Scan to Pay. GCash also empowers overseas Filipinos in 13 countries, with 3 more upcoming in May 2024, to manage their finances through GCash Overseas, which allows them to use their international mobile number to register for the GCash App and gives them access to services such as Buy Load, Pay Bills, and Send Money.

Moving beyond transactions, GCash incorporates sustainability across its innovation initiatives. The GForest movement empowers users to accumulate green energy and plant trees by simply using GCash. To date, more than 2.7M trees have been planted and 63.4K tonnes of carbon dioxide have been avoided, enabling our users to build a greener tomorrow.

Globe’s corporate venture builder, 917Ventures portfolio companies includes telehealth service platform KonsultaMD and Brave Connective Holdings, Inc., which brings together under its umbrella the companies that will help businesses strengthen their connection with customers through the use of data, analytics, targeting, and storytelling.

- KonsultaMD is a tech-enabled platform with the goal of providing universal access to healthcare through 24/7 online doctor consultations, in-clinic patient services, medicine delivery, and convenient at-home diagnostics and wellness services. It commits to building an ecosystem of care, empowering Filipinos to live better. The KonsultaMD SuperApp offers the full healthcare experience from 24/7 doctor consultations, pharmacy, to diagnostics at-home. With over 1,000 healthcare providers, 50+ specializations, and more than 2,000 pharmacy offers, KonsultaMD continues to serve Filipinos nationwide in 16+ dialects. With a vision to uplift the healthcare journey of every Filipino, KonsultaMD is a one-stop-shop superapp for health.

- Brave Connective Holdings, (BCHI)

- AdSpark, the award-winning and largest locally ad-based data powered digital media and creative agency which has launched more than 3,000 digital campaigns.

- M360, largest A2P multi-channel messaging platform, capable of sending messages to over 700 partner network operators in 190 countries via SMS or chat apps. Generates over 1.1 billion average monthly traffic with access to over 150 million mobile SMS users and over 45 million OTT users in the Philippines.

- DeepSea, enables programmatic advertising by leveraging first party data, millions of audiences and wide variety & unique audience segments to advertisers

- iNQUiRO, suite of data-driven products and solutions designed to create value for enterprises and their customers.

- Globe’s 917Ventures, Ayala Corporation, and Gogoro Inc. have introduced Gogoro Smartscooters® and battery-swapping in the Philippines in 2023. This collaboration brings forth a new era of sustainable transportation, offering smart, convenient, and accessible electric two-wheelers to

Key ESG Highlights: Building a sustainable future by creating a positive impact on both society and the environment

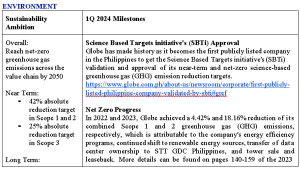

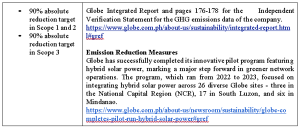

Globe’s Sustainability practice is anchored on Globe Purpose, “Uplift Filipino Lives Everyday”. By aligning with global sustainability frameworks, standards, and principles such as the United Nations’ Sustainable Development Goals (UN SDGs) and UN Global Compact and industry sustainability ambitions, the company is able to collaborate with its stakeholders to deliver positive societal and environmental impact. Globe is focused on addressing its material topics by scaling the integration of its sustainability practices within its business units, portfolio companies, and across the value chain.

Progress towards sustainability ambitions are disclosed in the Globe Sustainability website (https://www.globe.com.ph/about-us/sustainability.html) and in the annual Integrated Report (https://www.globe.com.ph/about-us/sustainability/integrated-report.html#gref). The 2023 Integrated Report is guided by the principles of the following frameworks:

- Reference to the Global Reporting Initiative (GRI) standards

- International Integrated Reporting Council (IIRC) Framework

- Sustainability Accounting Standards Board (SASB)

- Task Force on Climate-related Financial Disclosures (TCFD) recommendations

- United Nations Global Compact (UNGC) Principles

- United Nations Sustainable Development Goals (UN SDGs)

- Securities and Exchange Commission (SEC) recommendations

- Integrated Annual Corporate Governance Report (i-ACGR)

- Sustainability Reporting Guidelines

- GSMA ESG Metrics for Mobile

The annual integrated report is in compliance with the recommendations made in the Philippines SEC Memorandum Circular No. 4, series of 2019 on Sustainability Reporting for Publicly-Listed Companies (PLCs) and has undergone third-party external assurance for select sustainability metrics and GHG accounting conducted by DNV Business Assurance Singapore Pte. Ltd.

1Q 2024 Sustainability Updates